DC Generators for Hybrids

Trusted Supplier to Electric and Hybrid OEMs: DC Generators, DC Alternators, PM Motors, BLDCs

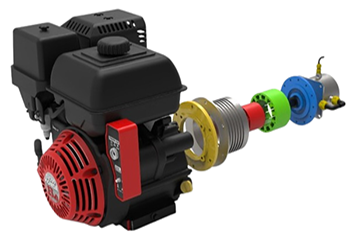

Engine mounted dc generators – the most compact hybrid generators.

Our Products

Hybrid Belt Generators

Larger power belt driven generators are more in demand as electrical power requirements increase for industrial mobile equipment. Storing this power in battery

We Are Here To Serve You

Innotec Power is a leading manufacturer of Permanent Magnet Alternators, Motors and Control Systems. The company invests heavily in research and design to innovate reliable solutions for power generation, transmission and control in the industrial, mobile and renewable energy sectors.

Established in 2009, Innotec Power has come a long way to be a leading manufacturer of permanent magnet alternators and brushless DC motors which find applications in hybrid vehicles, electric vehicles, wind technologies, DC diesel generator sets, biogas plants and more.

The company’s focus has always been to innovate products that solve the problems of efficiency in power generation and transmission. Fueled by the leading minds and people of the industry, its products outperform competition based on efficiency, size and customization. The passion of the founder and the zeal of Innotec’s employees have made the company’s products an important provider for electricity generation.

Latest News

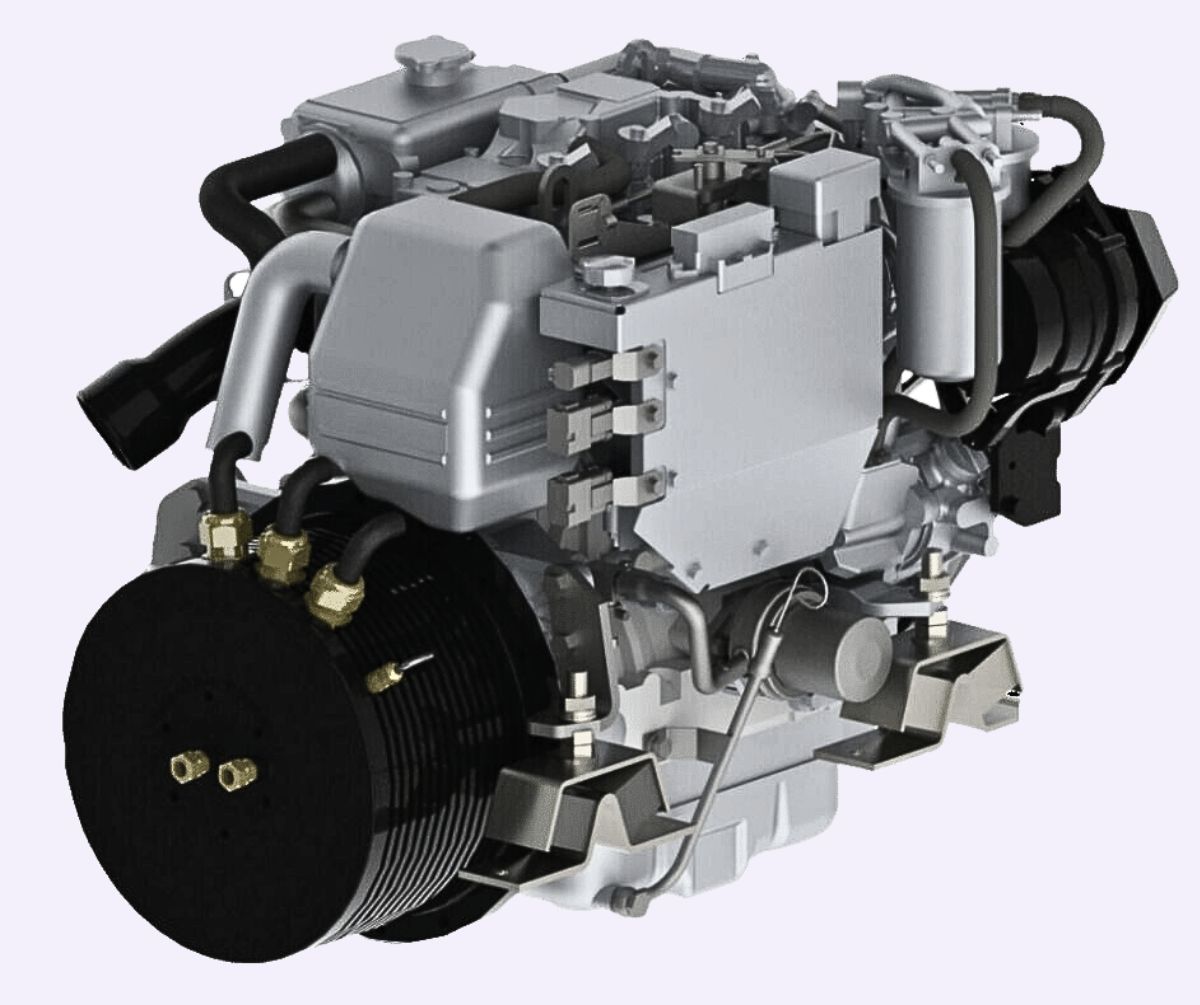

Liquid Cooled DC Generators

The need for liquid cooling in DC Generators is determined by a number of system design parameters. Power/Amperage Requirement: Many… read more

48V DC Generators

For battery charging applications, Innotec’s DC Generators are designed based on the battery bank size. One of the most… read more

Hoist Motors

Introduction to Hoist Motors Hoist motors are the motors used in overhead cranes, and electric hoists that lift heavy loads… read more

Crane Motors

Crane Motors and Lifting Machines In industries ranging from construction to logistics, crane and lifting machines facilitate the movement and… read more

Hydraulic Pump Motors

Hydraulic Pump Motors Hydraulic pump motors are like the engines of hydraulic systems, turning electrical energy into mechanical power to… read more

EC FANS : BLDC Motors

Understanding EC Fans EC fans, short for Electronically Commutated fans, are a significant advancement in the air circulation technology. Unlike… read more

Direct Drive Cooling Tower Motors

Direct Drive BLDC Motors for Cooling Tower Innotec’s innovative approach combines advanced technologies to create high-performance direct drive BLDC motors… read more

On-Board Charger

On-Board Charger/ On-Board Range Extender An on-board charger is an additional power source that is integrated into electric vehicles to… read more